What are the behavioral patterns that inhibit a trader’s success?…

One of the primary factors that create errors for traders is FEAR, because our minds are wired to avoid pain.

Many mental mechanisms exist, some of which we’re conscious of and some of which we’re not; it’s really the ones we aren’t conscious of that create the big problems.

Most often, traders have FOUR FEARS.

- There’s the fear of being wrong,

- The fear of losing money,

- The fear of missing out

- and The fear of leaving money on the table.

I found that basically, those four fears accounted for probably 90% to 95% of the trading errors that we make.

Let’s put it this way: If you can recognize opportunity, what’s going to prevent you from executing your trades properly? YOUR FEAR. YOUR FEARS IMMOBILIZE YOU.

Your fears distort your perception of market information in ways that don’t allow you to utilize what you know.

THEY’RE CULTURALLY INBRED.

It’s virtually impossible to grow up in any culture without learning to become afraid of something — of being wrong, or of losing something.

————-

First of all, people generally don’t understand that fear. Not only does it debilitate us physically, but it also weakens us perceptually.

Fear causes us to narrow our focus.

With all this information available at any given moment, what fear will do is cause us to narrow our focus onto the object of our fear.

Our fear is a natural mechanism that tells us that there’s a possibility of experiencing pain.

To avoid that pain, what am I going to do? I’m going to focus my attention on it so that I can get away from it and protect myself.

As traders, we get into a situation where we’re confronted with the possibility that a trade isn’t working, but we don’t want to acknowledge that because to do so may tap us into the accumulated pain of every single time we’ve ever lost something.

That’s why for most traders, A TRADE JUST IS NOT A TRADE. Most traders place far too much significance and meaning on each trade, making it difficult to cut losses or admit they’re wrong. And as a result, what do we do? We avoid the possibility! And by avoiding it, it generally gets worse.

Then you go back and look at the situation and say, “Well, I knew what was happening here because this particular pattern told me that the market had the potential to go against me, but I didn’t take advantage of it.”

And why didn’t you? Because you’ve reached a situation where you don’t trust yourself. You continue to build a self-image that says, “I can’t be trusted.”

Yes, most people rationalize that away.

Traders are constantly indulging themselves in rationalizations and justifications to hesitate or jump the gun or hoping the market will come back to cut their losses. It obviously doesn’t work. AND WE END UP NOT TRUSTING OURSELVES…

We end up not trusting ourselves to always act in our own best interests and consequently end up fearing our own behavior.

This is one of the key issues.

It’s not the market that we’ve become afraid of, it’s really our own response to THE MARKET THAT WE’RE AFRAID OF. Now most traders don’t look at it that way, but this lack of trust is a major source for the lack of confidence that most traders experience.

You have to learn how to change your beliefs by reinterpreting what it means to LOSE, and what it means to be WRONG.

In essence, you have to change many of the beliefs that cause you to interpret market information in a painful way.

You have to create a whole new set of beliefs that allow you to see the market from a carefree state of mind, as well as a set of beliefs that always compel you to act in your own best interests.

You want to reach a point where you’re trading without hesitating, very much like the way great athletes perform.

As traders, if you want to make the most money, YOU HAVE TO CREATE CONSISTENCY.

And the best way to create consistency is to control the process of perception and interpretation so that you operate out of an objective frame of mind and as carefree a state of mind as possible.

FEARS are the source of trading errors that create a lack of consistency.

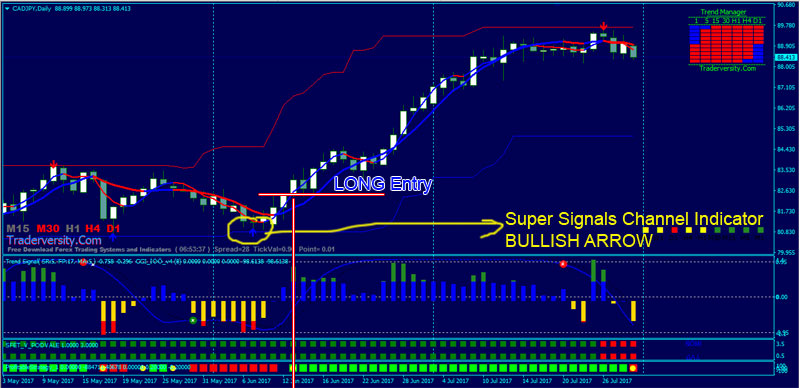

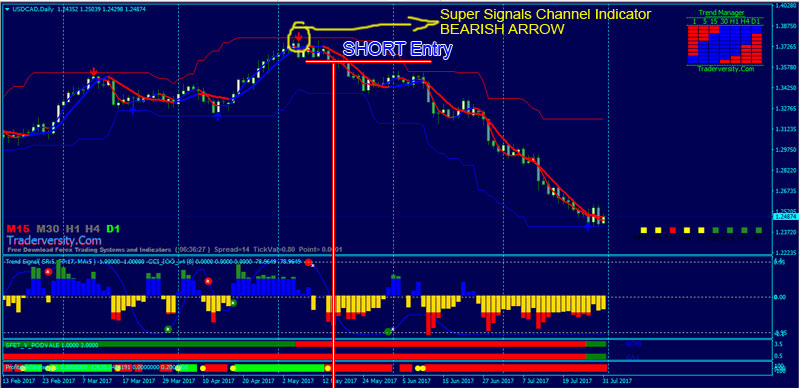

High Accuracy Forex Donchian Channel Trading Strategy with Super Signals Channel Indicator.

Placing stop loss is easy: Just Place your stops outside of the channel lines. But your stop loss should be determined by the timeframe you are trading in.

- If you are trading on 5-minute charts, place your stop loss 10-15pips outside of the channel line.

- If you are trading in 1hr or 4 hr charts, you stop loss should be 20-50pips outside of the channel line.

HOW DO YOU SET YOU TAKE PROFIT TARGETS?….

Set your take profits to 3 times the amount your risked: for example, if you stop loss is 20 pips then set your take profit target to 60pips.

[sociallocker]

DOWNLOAD TRADING SYSTEM [/sociallocker]

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast