Easy and High Accuracy Forex Simple Momentum Stochastic Oscillator Trading Syatem and Strategy. There is no trader on this planet that made fortune in Forex by trading single indicator strategy.

To get an overall view and confirm trends, reversals, momentum and volatility more accurately, you must use Stochastic Ocillator with other indicators, chart patterns and price movements.

The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals.

This indicator measures momentum by comparing closing price to the trading range over a given period.

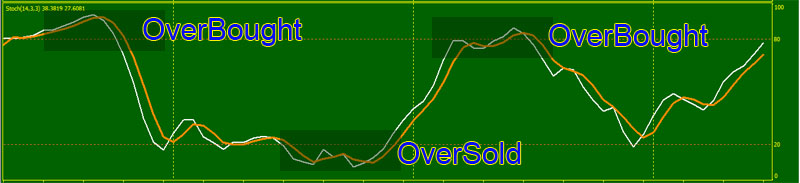

Ranging from 0 to 100, the stochastic oscillator reflects overbought conditions with readings over 80 and oversold conditions with readings under 20.

Crossovers that occur in these outer ranges are considered particularly strong signals.

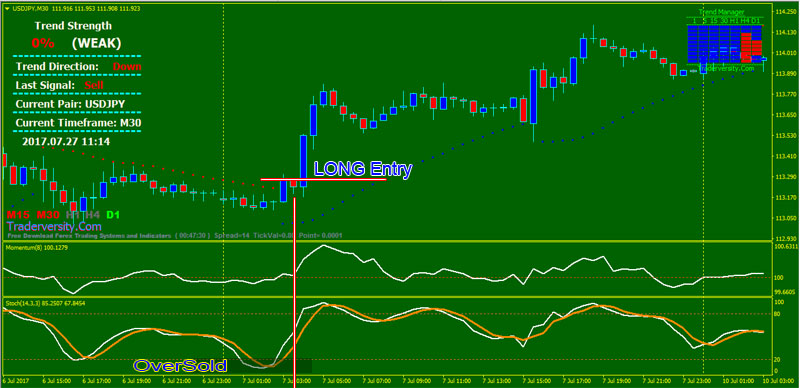

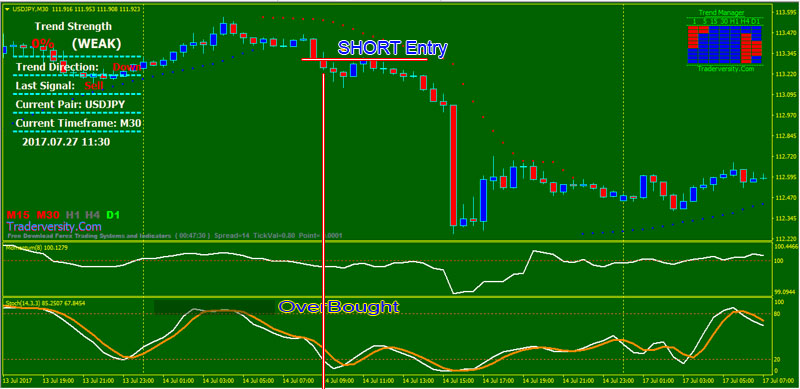

The momentum indicator is displayed as a single line, on its own chart, separate from the price bars, and is the bottom section in the example chart.

The Momentum indicator is a speed of movement indicator designed to identify the speed (or strength) of price movement.

The momentum indicator compares the most recent closing price to a previous closing price (can be the closing price of any time frame).

The momentum indicator identifies when the price is moving upwards or downwards, and by how much.

When the momentum indicator is above 100, the price is above the price “n” periods ago (it’s a BUY signal), and when the momentum indicator is below 100 the price is below the price “n” periods ago (it’s a SELL signal).

How the far the indicator is above or below 100 indicates shows how fast the price moving. A reading of 101 shows the price is moving quicker to the upside than a reading of 100.5.

The trading system works best with the trend following strategy.

A basic stochastic trend following signal is a signal line crossover, occurring when the %K line crosses the %D line in confirmation with the trend.

When %K (short-term line) crosses below %D (long-term trend) and returns above it, you can consider it an uptrend and a BUY signal. The reverse holds true for a downtrend.

- Best Time Frames: H1 or higher

- Recommended Currency Pair: USDJPY

- Stochastic Oscillator line crosses up from oversold area

- Momentum line upward above 100 level

- Signal Manager Blue color bars

- Parabolic Sar Blue color dots below the upward price

- Stochastic Oscillator line crosses down from overbought area

- Momentum line downward below 100 level

- Signal Manager Red color bars

- Parabolic Sar Red color dots above the downward price

Always use Stochastic Oscillator on multi-frame

Sometimes traders get confused analysis markets on many time frames at the same time.

An hourly time frames may give you bearish signals but your daily or weekly time-frames may show bullish signals.

If you wait for the lower time frame to revert to the direction of the larger time-frame, the stochastic will start showing bullish signals on both charts. But this is time-consuming.

Discipline and patience are the keys.

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast

![CMS Trend MT4 Forex Trading System with RSI Trend Bar Filter [7627]](https://traderversity.com/wp-content/uploads/2019/11/CMS-Trend-MT4-Forex-Trading-System-150x150.jpg)