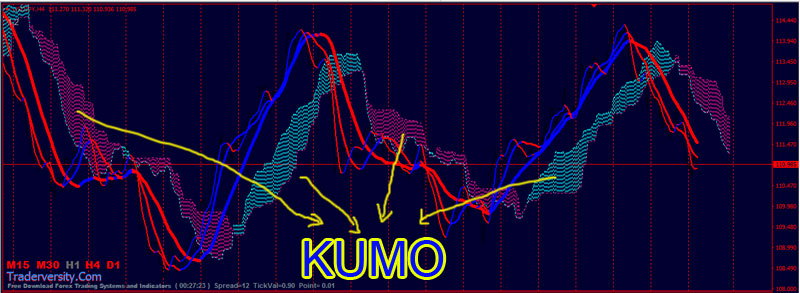

High Accuracy USDJPY and GBPJPY Kumo Trend and BreakOut Trading Strategy. How to trade Forex (USDJPY and GBPJPY) with the Kumo of Ichimoku Kinko Hyo Indicator.

This is a super effective Forex Ichimoku Kumo and Non-Lag Moving Average Trading System and Strategy for USDJPY and GBPJPY currency pairs.

The Kumo of Ichimoku Kinko Hyo is typically looked at in terms of support and resistance; if it is thick, then the support/resistance is strong (depending on the position of price in relation to the cloud). Read: How to Trade Forex Successfully with Tenkan-Sen Kijun-Sen Filter System

By contrast, if it is thin, then the S/R levels are considered weak.

Generally, if the price is above the Kumo, then there is an uptrend in place and/or more buying opportunities. If the price is below the Kumo, then it is under resistance and it is better to be looking for shorts instead of longs.

The longer price action stays above or below the Kumo, the stronger the trend and the more support/resistance the Kumo offers.

The Kumo can be very effective for options traders as well as the trend/momentum traders. This is because the price will stay on one side of the Kumo during a trend. The farther the price action is from it, the stronger the trend and more volatile it is.

By using the Kumo, we can qualify the current reversal, which provides traders with a unique opportunity to either take profits on current positions or take a new reversal setup.

It is effective in timing trends, reversals and trading strategic reversals when all the elements are in place. Its ability to measure support and resistance enables the Ichimoku to also provide traders with a unique perspective on the markets.

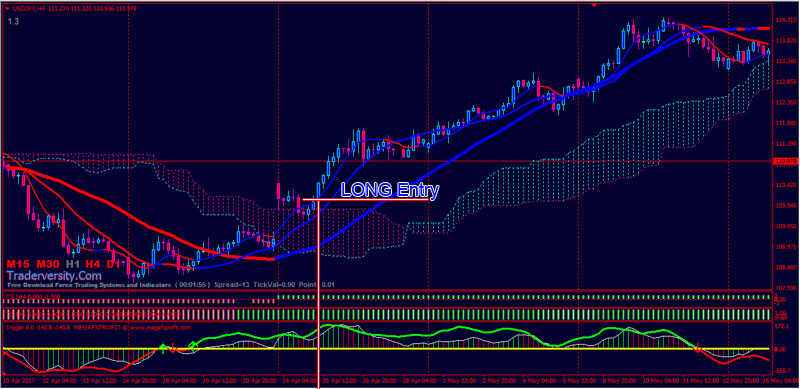

- Best Time Frames: H4 (4 Hour)

- Most Recommended Currency Pairs: USDJPY and GBPJPY

- Price is above the Kumo

- Non-lang 21 MA Blue color and above Blue color Non-lang 50 MA

- Non-lang 50 MA Blue color and above Blue color Non-lang 100 MA

- TS-1 # 4 and TS-1 #5 Green color bars

- Trigger indicator Green color and above 0 level

- Cracked Mega FX Green color and above 0 level

- Price is below the Kumo

- Non-lang 21 MA Red color and below Red color Non-lang 50 MA

- Non-lang 50 MA Red color and below Red color Non-lang 100 MA

- TS-1 # 4 and TS-1 #5 Red color bars

- Trigger indicator Red color and below 0 level

- Cracked Mega FX Red color and below 0 level

This is a super effective Forex Ichimoku Kumo and Non-Lag Moving Average Trading Strategy for USDJPY and GBPJPY currency pairs.

Yes of course… you can use the trading system for all currency pairs but most recommended pairs are USDJPY and GBP USD.

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast

Forex Stocks Crypto Trading Strategy Forex Strategies – Forex Resources – Forex Trading-free forex trading signals and FX Forecast